Auto-generate executive briefings

Generate tailored briefings for executives based on their unique needs and potential questions.

4 ways this AI play transforms your executive briefings

Auto-generate executive briefings

Use this template to cut executive reporting from hours to minutes.

Ready to get started? Your step-by-step guide

Get started in minutes. Grab the template, then follow our walkthrough to quickly tailor these proven AI workflows to your business.

Expert tips for using this play

Start by entering an executive’s title

A set of recommended KPIs will generate automatically, which you can then tailor to align with your specific goals and focus areas.

Set your update cadence

By default, updates are scheduled weekly. However, you can easily adjust the frequency, whether that’s once a month, every other week, or another cadence that works best for your team.

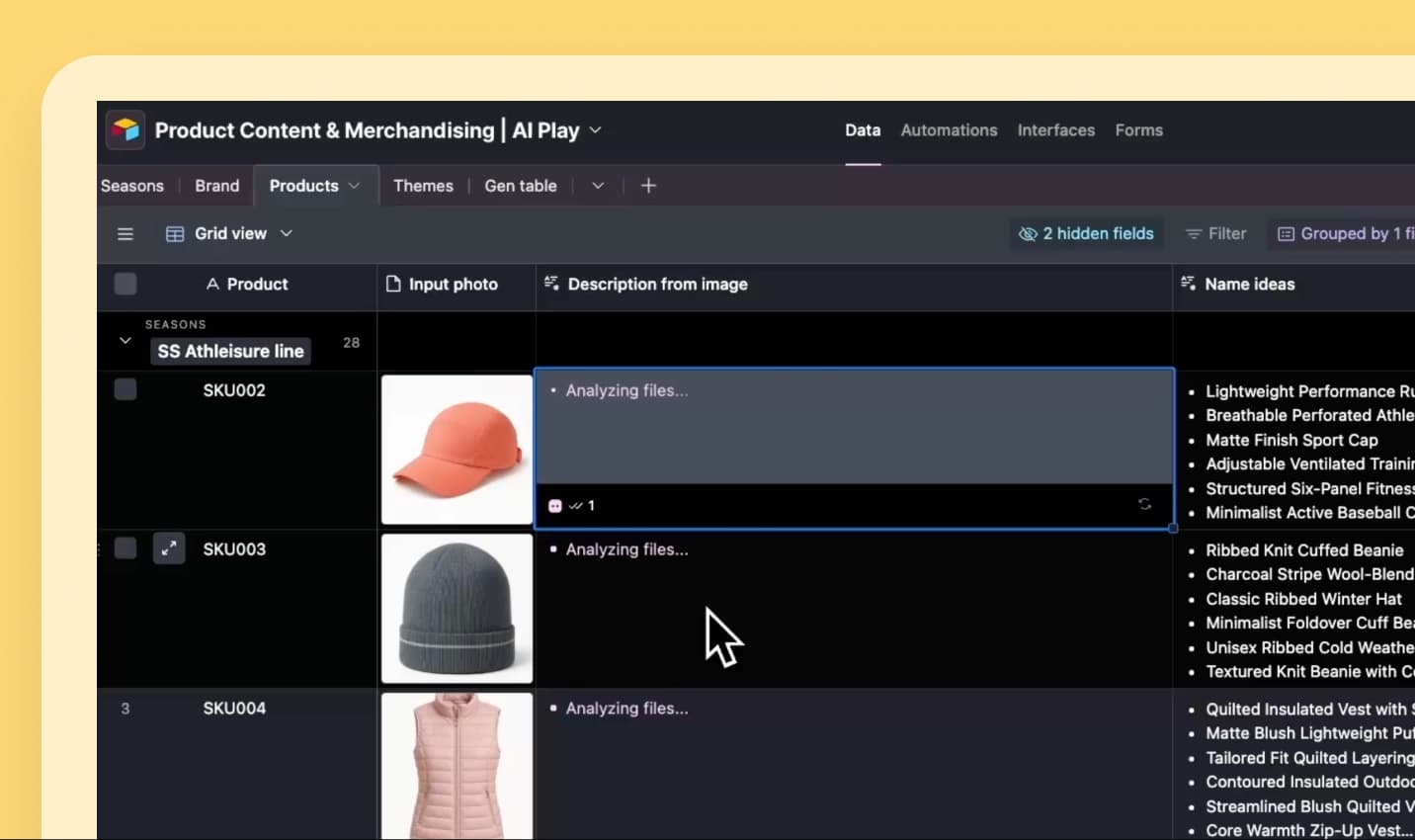

Save time by uploading screenshots from Slack threads instead of typing updates manually

AI will analyze the image, pull out the key details, and automatically fill in the update field with those insights.

Why Airtable?

Airtable’s operations management software brings all your data together, so you can create and standardize your workflows and hit ambitious business goals. Instantly build tailored business apps through natural conversation with Omni, your expert AI builder. Deploy a team of dynamic Field Agents that analyze data and orchestrate actions across your entire operation.

Iterate and edit at the pace of your changing business. It’s as simple as point, click and chat. No technical expertise required.

Want a demo or have questions?

See first hand how Airtable empowers you to reimagine your workflows with AI.